Chime Mobile is an app that allows you to manage your finances on the go. It also allows you to save money automatically. It rounds up your debit card purchases to the nearest dollar and transfers the difference to your savings account. This feature is great because it keeps your money in savings. Small amounts add up over time.

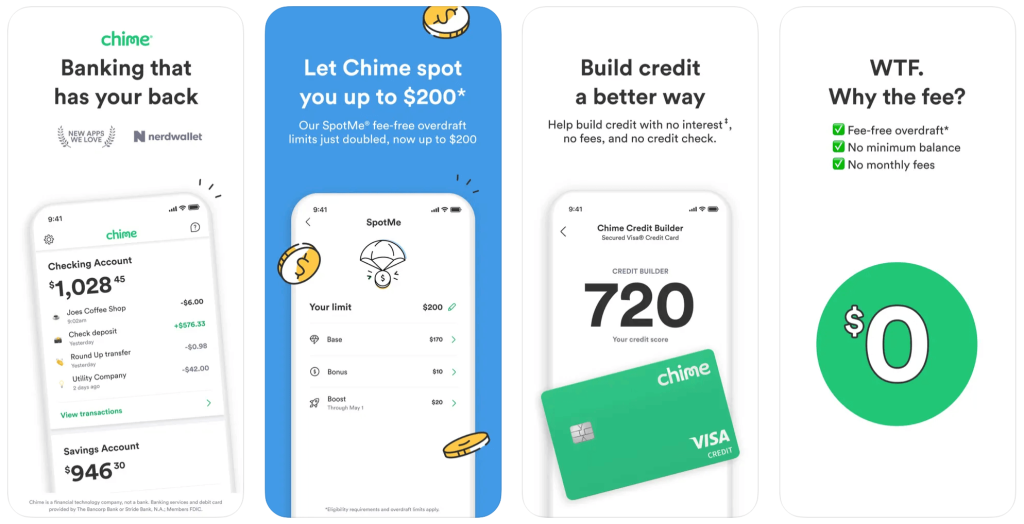

Unlike your traditional bank, Chime app does not charge you any fees for using the app. The app offers savings and checking accounts. You can also transfer money between accounts through Chime, and you don’t have to worry about any fees. You can set up automatic payments and even set up early direct deposits. Another great feature of Chime is that there are no foreign transaction fees.

Chime Mobile app lets you keep track of your spending with its intuitive app. It also connects to your other accounts, allowing you to see your balance at any time. You can even use the app to pay bills and send money to friends and family. Chime also supports Samsung Pay, Google Pay, and Apple Pay, making it even easier to pay bills while on the go. Chime App download is easy.

[quads id=4]

What Are the Features of Chime Mobile App?

Chime app offers some attractive features to its users, but one thing it doesn’t offer is a traditional overdraft protection plan. This means that if you overdraw outside of the bank’s SpotMe program, you won’t have your transactions covered, and your payments will probably be declined.

- Fee-friendly

Chime App is fee-friendly and offers a variety of banking options. It offers no overdraft fees or account minimums. It also offers customer service to assist customers when they need it. It’s a good option for those who like a more modern online banking experience but prefer to bank at their local branch.

- Overdraft protection

The Overdraft protection features of Chime Mobile App are designed to protect you from overdraft fees. The app displays your overdraft limit and allows you to access the money immediately. It also allows you to transfer money to another account or external transfer account without incurring overdraft fees. In addition, you can use your debit card to make purchases, which can help you avoid overdraft fees.

- Pay friends feature

The Pay friends feature of Chime App allows you to send money to your friends without having to use your actual bank account. All you need is an account with Chime. After that, you can send money to a non-Chime user by entering their email address or phone number. This will automatically send them a message with an alert, letting them know that they’ve received the money.

[quads id=4]

- No monthly maintenance fees

Whether you’re a new account holder or an existing customer, there’s no reason not to take advantage of no monthly maintenance fees with Chime App. Chime allows you to have a free checking and savings account, as well as deposit money up to two days early. You’ll also receive your paychecks automatically. The best part is that you can do it on your mobile device!

- No minimum balance fees

Chime’s mobile app does not charge a monthly minimum balance fee, and users have no waiting period or lost checks. Instead of waiting for a check to clear, Chime lets you access your money as soon as your employer deposits it. This means you can get paid up to two days earlier than you would with traditional banks. Plus, Chime is compatible with nearly all bank accounts and allows you to automatically set up automatic savings. When you make a purchase, Chime automatically deposits the cost into your savings account.

- No foreign transaction fees

One of the major advantages of using Chime for mobile banking is that there are no foreign transaction fees. Chime also promises that money from direct deposits will reach your account within the same business day, whereas some banks can hold on to your money for two days. Other features include automatic savings tools, including transferring a portion of your paycheck into a savings account each pay period. You can also automatically round up your purchases and deposit change into savings. However, you can choose to turn off these automatic tools if you’d like.

Download Chime App to get started.